Check-Up: Is Your Business Structure Still Serving You?

Your business is evolving—your entity strategy should evolve with it.

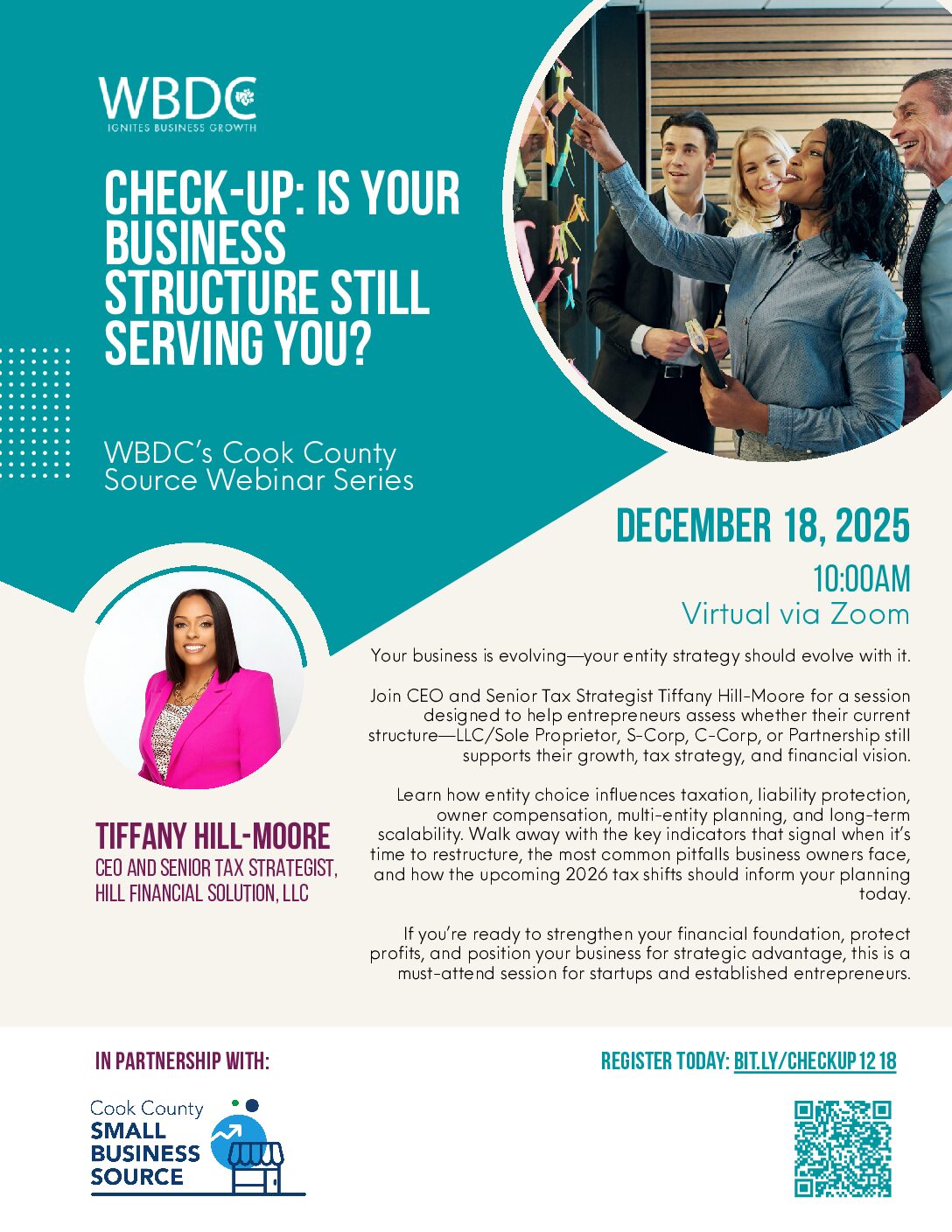

Join CEO and Senior Tax Strategist Tiffany Hill-Moore for a session

designed to help entrepreneurs assess whether their current

structure—LLC/Sole Proprietor, S-Corp, C-Corp, or Partnership still

supports their growth, tax strategy, and financial vision.

Learn how entity choice influences taxation, liability protection,

owner compensation, multi-entity planning, and long-term

scalability. Walk away with the key indicators that signal when it’s

time to restructure, the most common pitfalls business owners face,

and how the upcoming 2026 tax shifts should inform your planning

today.

If you’re ready to strengthen your financial foundation, protect

profits, and position your business for strategic advantage, this is a

must-attend session for startups and established entrepreneurs.

- Language: English